Our Approach

Our Approach – Home

Market Opportunity

Leading the Sports Entertainment Revolution

The sports industry is booming, with unprecedented investment in women’s leagues, youth sports, and niche markets. Simultaneously, giants like Netflix, Disney, and Nike are fueling a surge in sports streaming, transforming how fans engage with their favorite competitions.

Clash on the Track is uniquely positioned to capitalize on this momentum with a groundbreaking model that fuses elite competition, live reggae music, and community impact. As demand for innovative sports experiences grows, we’re leading the way, creating a movement that inspires athletes, fans, and investors worldwide.

Growing Private Investment in Underrepresented Sports

In recent years, there has been a surge in private capital directed towards women’s sports, youth sports, and non-traditional leagues. Investors are keen on untapped markets with high growth potential, recognizing that they can deliver both financial returns and social impact.

- Women’s sports have seen explosive growth, with the WNBA securing $75 million in private investments,

and viewership for women’s sports has increased by over 300% in the last decade.

- Youth sports are now a $19 billion industry in the USA, with investors funding grassroots programs and

creating pipelines for future sports stars.

Untapped Potential in Track and Field

While track and field enjoys massive viewership during events like the Olympics, the sport remains under-commercialized during

non-Olympic years. Investors have largely overlooked the potential of year-round engagement with track and field, which has

billions of global fans.

Clash on the Track provides a new format that transforms traditional track and field events into high-energy entertainment

spectacles. Our events will attract media attention, sponsorship deals, and fan engagement, offering year-round visibility for

brands and investors.

Social Impact and Philanthropy

There is a growing trend towards impact investing, where investors look for opportunities that combine financial returns with positive social outcomes. Clash on the Track is a mission-driven event that donates 40% of its profits to financially struggling athletes and youth sports programs through the Strides Foundation.

The Rise of Sports as Entertainment

Sports events are no longer just about the competition—they are also about entertainment and immersive fan experiences. The shift toward high-production-value sports events, like the Super Bowl or NBA All-Star Weekend, has shown that fans crave more than just the game—they want a spectacle.

Clash on the Track capitalizes on this by combining head-to head races with live music, celebrity appearances, and fan zones. This entertainment-driven format not only increases fan engagement but also opens up new revenue streams for media, sponsorships, and digital content.

Our Approach

Capital Structure Overview

To fund our mission and ensure sustainable growth, we are raising $20M through a balanced mix of equity financing, convertible debt, promissory notes, and equity crowdfunding. This diversified approach minimizes equity dilution, provides flexibility, and supports long-term growth, enabling us to deliver impactful results for our business and community.

Breakdown of Capital Sources:

Equity Financing ($8M, 20% equity):

Funding from private investors to support operations while retaining majority control.

Convertible Debt ($5M):

Sophisticated investors benefit from a $50M valuation cap and a 15-20% equity discount, offering flexibility and future upside.

Promissory Notes ($5M, 8% interest):

Provides private investors with stable returns while ensuring manageable cash flow for the business.

Equity Crowdfunding ($2M, up to 5% equity):

Engages fans early, turning them into stakeholders and building loyalty through a shared sense of purpose.

Why This Structure Works:

- Diversification: Reduces reliance on any single funding source.

- Investor-Friendly: Balances flexibility for investors with financial stability for the company.

- Fan Engagement: Crowdfunding strengthens our community from day one by creating emotional connections with supporters.

Reducing Dependence on Capital:

We are also leveraging alternative income sources to reduce reliance on external capital, including:

- Advanced payments from sponsors.

- Ticket presales and merchandise sales.

- Donations to the Strides Foundation.

Our Capital Strategy

Overview of the $20M Target

We aim to raise $20M to support both our business operations and the impactful initiatives of the Strides Foundation. This funding will drive event production, marketing, athlete recruitment, and community programs, ensuring sustainable growth and meaningful impact.

Funding Sources:

- Equity Financing: $8M from private investors, offering 20% equity.

- Convertible Debt: $5M with a $50M valuation cap and a 15-20% equity discount.

- Promissory Notes: $5M with an 8% interest rate, ensuring predictable returns for investors.

- Equity Crowdfunding: $2M, offering up to 5% equity, fostering fan engagement and loyalty.

Fan Engagement Through Crowdfunding:

Equity crowdfunding allows us to transform supporters into stakeholders, creating an emotional connection that goes beyond financial participation. This approach builds a loyal community that shares in our mission and success.

Future Financial Sustainability:

We are committed to reducing external capital dependence through:

- Revenue from sponsorships and merchandise.

- Ticket sales and advanced payments.

- Continued support from the Strides Foundation.

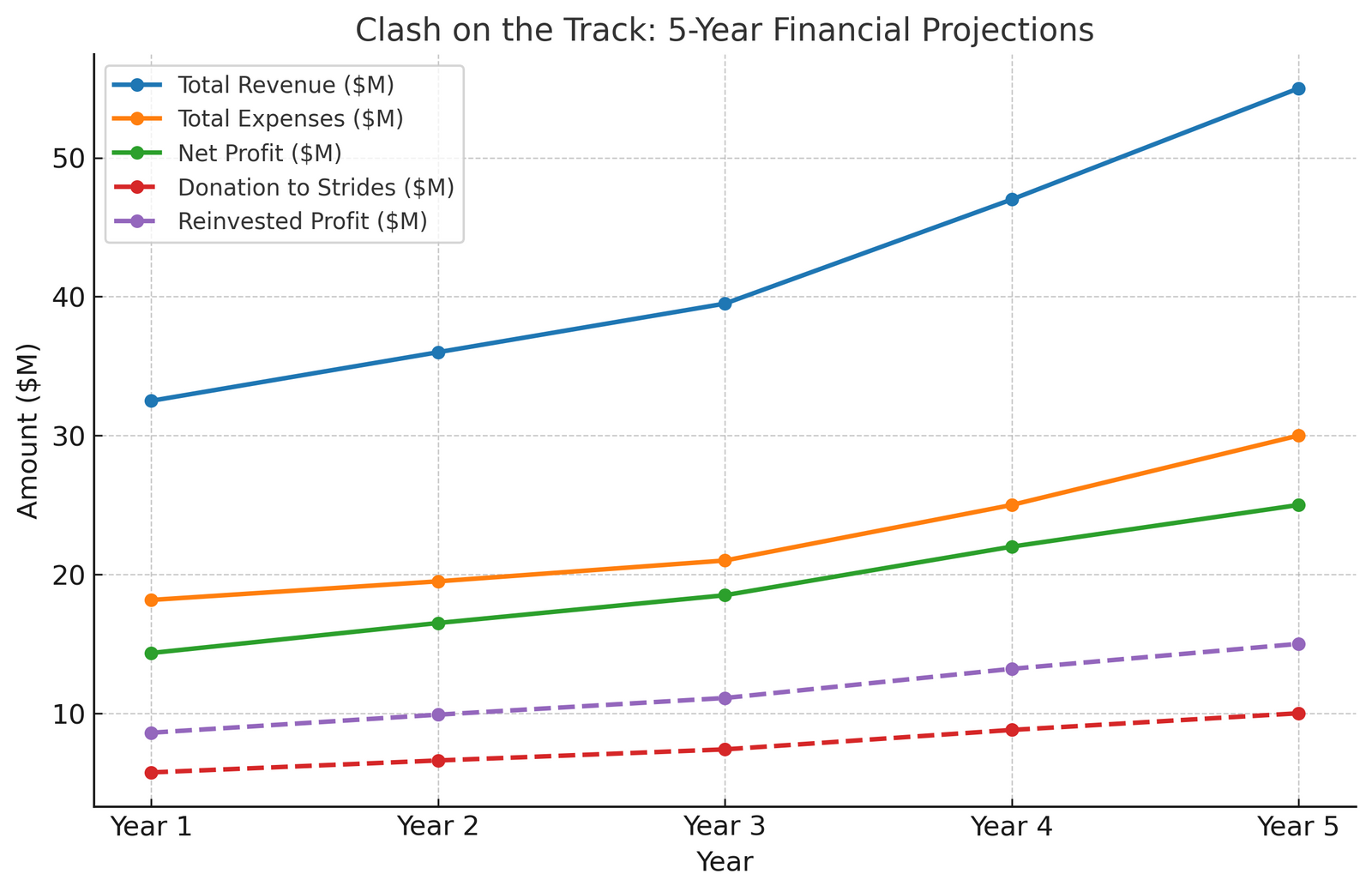

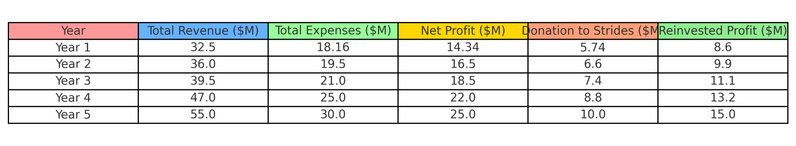

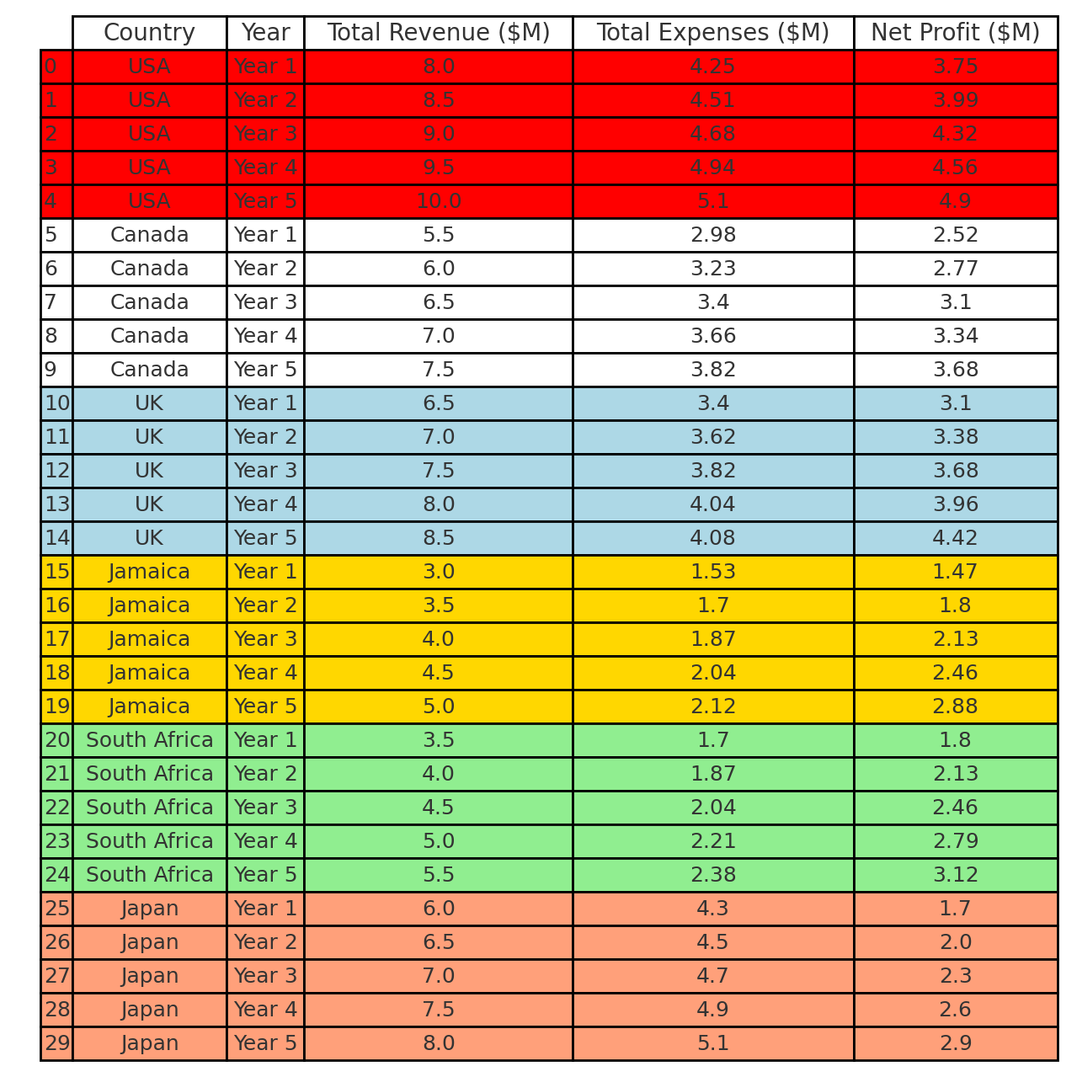

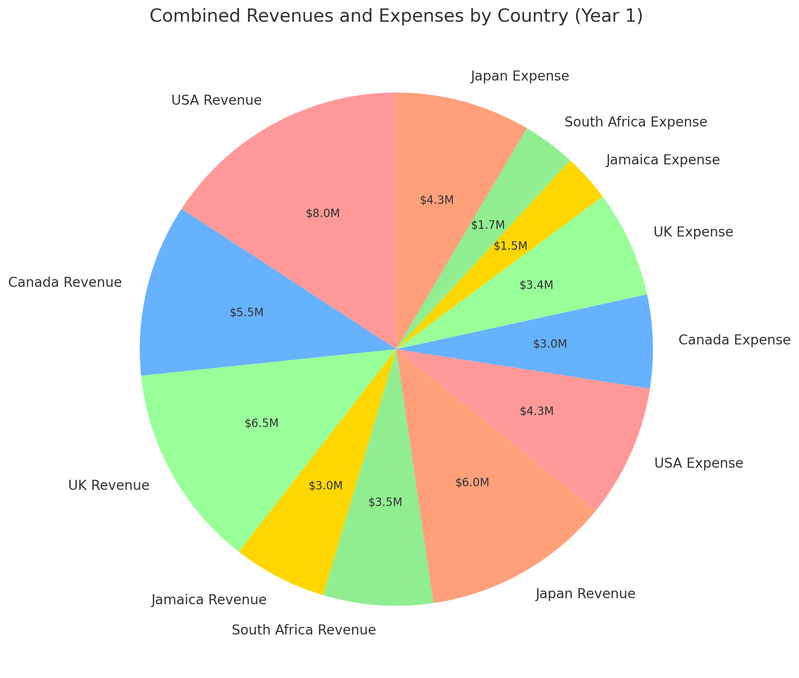

Financial Projections

Ticket Sales

- Revenue from live event tickets, including VIP packages and general admission.

- Projected Contribution: 25% of total revenue.

Merchandise Sales

- Income from branded apparel, accessories, and exclusive event merchandise.

- Projected Contribution: 5% of total revenue.

Sponsorships and Partnerships

- Corporate sponsorships from global brands, media partners, and athlete endorsements.

- Projected Contribution: 50% of total revenue.

Digital Streaming & Pay-Per-View

- Subscription-based streaming and pay-per-view ticketing for global audiences.

- Projected Contribution: 15% of total revenue.

Concessions

- Food and beverage sales at live events.

- Projected Contribution: 5% of total revenue.

Supporting Chart

The chart below outlines the projected revenue, expenses, and net profit for Years 1-5.

Investment Needs

We aim to raise $20M through a mix of equity financing, convertible debt, promissory notes, and equity crowdfunding. This balanced approach ensures flexibility, minimizes dilution, and supports growth.

Capital Breakdown

- Equity Financing ($8M, 20% equity): Selling 20% equity to private investors for operational funding while retaining majority control.

- Convertible Debt ($5M): Raising $5M with a $50M valuation cap and 15-20% discount for future equity conversion, reducing immediate dilution.

- Promissory Notes ($5M): Offering $5M at 8% interest with interest-only payments for 2 years, followed by repayment over 5 years.

- Equity Crowdfunding ($2M, 5% equity): Engaging fans by offering up to 5% equity, turning supporters into stakeholders.